Easy ways to send money to Banesco in Venezuela from the US

If you want to send money to Banesco Venezuela, this article is exactly what you need. Sending money is a great way to support your loved ones with things like groceries, covering rent, or offering financial relief. It’s one of the best things you can do to express your care and love.

Banesco Banco Universal is Venezuela's largest and most trusted financial institution.1 With millions of customers and a strong nationwide presence, Banesco plays a key role in helping Venezuelans manage their day-to-day finances. Many rely on the company for various stable banking services.

Methods to send money to Banesco in Venezuela

Here are the main options for sending money to Venezuela from the USA and how they compare.

Online money transfer services

Online platforms are the most convenient way to send money to Banesco Venezuela. Services like BOSS Revolution’s BOSS Money app, MoneyGram, and Xoom (a PayPal service) allow you to complete transfers from your phone or computer in just minutes.

These platforms typically support bank deposits and offer features like real-time transfer tracking, currency conversion, and saved recipient details for faster repeat transactions.

Bank wire transfers

With the bank wire transfer method, you usually have to visit your bank or use online banking, if available. Then, provide full recipient details and cover any associated fees. Bank fees are usually higher than online services and can include the following.

- Outgoing wire transfer fees from your U.S. bank

- Intermediary bank fees

- Foreign exchange markup

Bank wire transfers to Banesco can also take several business days, making them a less attractive option if speed matters.

Step-by-step guide to sending money to Banesco

The BOSS Money app makes it fast and simple to send money to Banesco, and your first two transfers are free. You can also use promo code APPBONUS to get three free transfers instead.

Here’s how to send money to Venezuela in just a few steps.

- Download and set up the BOSS Money App: Find the app in the App Store or Google Play and install it. Sign up using your mobile number.

- Select destination and enter amount: Choose Venezuela as your destination, and then type in how much you want to send. You’ll see the current exchange rate and how much your recipient will receive.

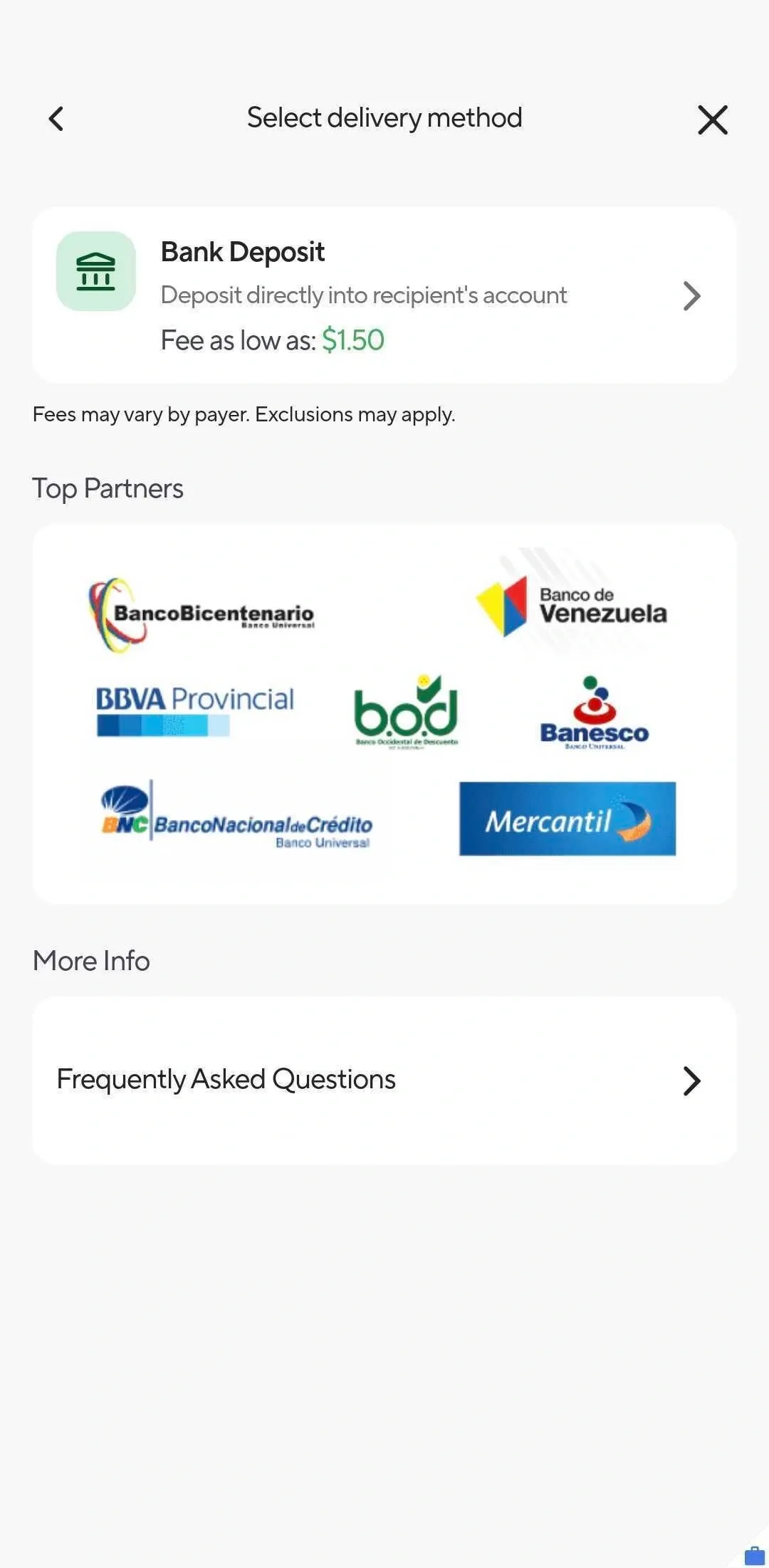

- Choose delivery method: Select home delivery, bank deposit, or cash pickup. The available methods will depend on your destination.

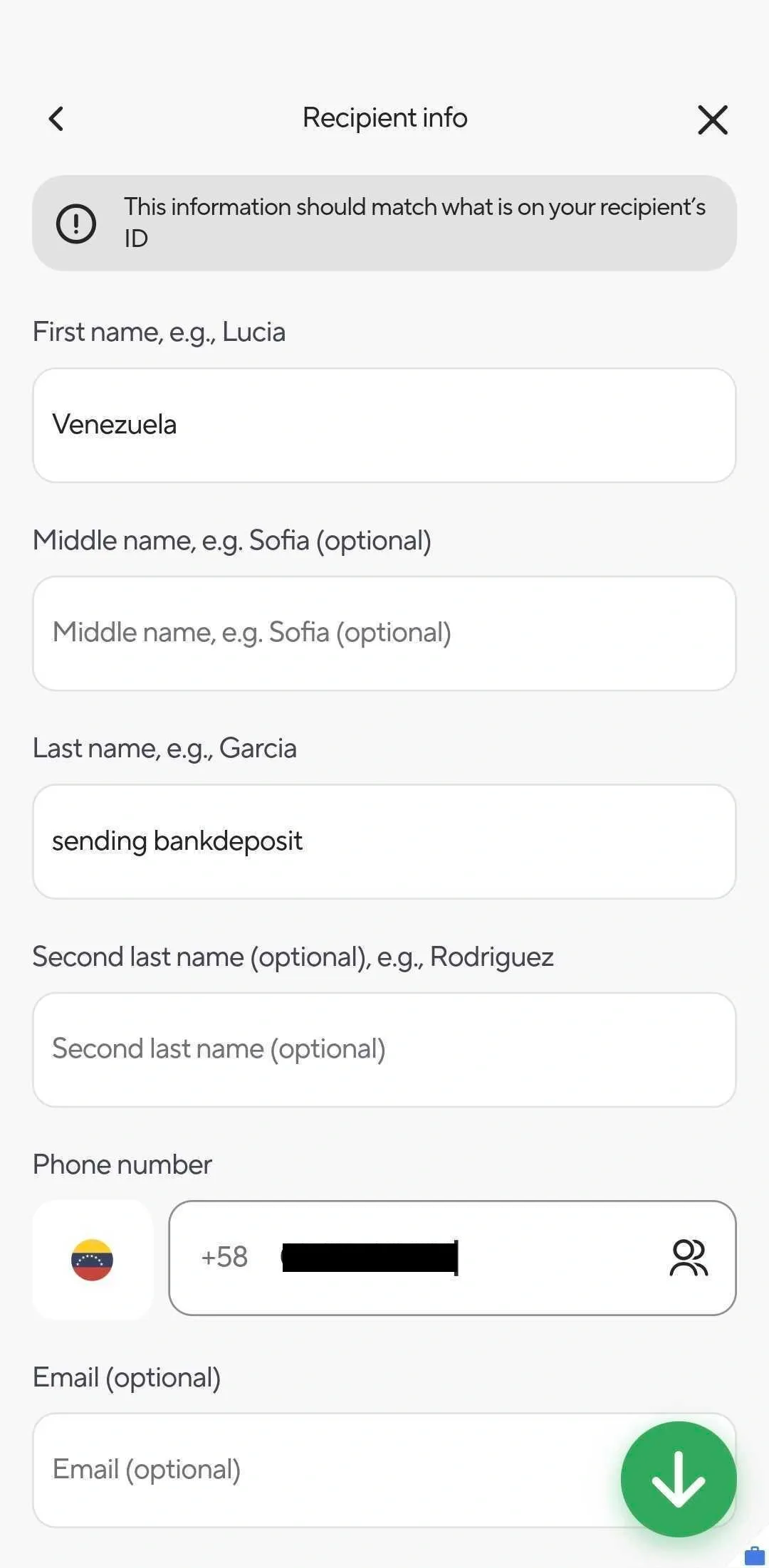

- Add receiver details: Enter your recipient’s information, like full name, Banesco account number, and phone number. You can also pull information from your phone’s contacts.

- Pick a payment method: Pay using a debit or credit card. Note that your provider may apply a surcharge if you’re using a credit card.

- Send and track: Hit Send, and you’re done. You can track your transfer in real time within the app and get notified once the money is delivered.

Fees and processing times for sending money to Banesco

Here’s a comparison table of transfer fees and processing times across various services.

| Service | Min / Max transfer amount | Fees | Transfer speed |

|---|---|---|---|

| BOSS Money App | $10 / $2,999 | $0 for first 2 transfers; low variable fees after; 1 free Tuesday/month | Typically within minutes to a few hours |

| MoneyGram2 | Varies / Up to $10,000 | Starts at $4.99 (online) | Minutes to a few days |

| Xoom (PayPal)3 | $10 / $2,999 daily (limits apply over time) | Starts at $1.99; varies by payment method | Minutes to 4 business days |

| Ria4 | $1 / $2,999 daily, $7,999 monthly | Starts at $3.90 | Minutes to 5 business days |

All third party information obtained from applicable website as of March 27, 2025

Exchange rate considerations

When sending money overseas, exchange rates can affect how much your recipient receives. Even if a service charges low transfer fees, a poor exchange rate can eat into the value of your transaction. For example, a small difference of 1–2% in the exchange rate can be significant if you send money frequently.

BOSS Money is known for offering competitive and transparent exchange rates. The app clearly shows the current rate when you enter the transfer amount, so there are no surprises.

In general, here’s what to look for when evaluating exchange rates.

- Real-time rate previews: Make sure the platform shows the rate before you send.

- Total amount received: Always compare how much the recipient will get after conversion.

- Consistency: Look for platforms that offer stable, fair rates rather than fluctuating wildly.

Common issues and how to avoid them

Even with reliable services, things can occasionally go off track. But these issues are usually avoidable. Knowing what to watch for is half the battle.

Here are the most common causes of delays when sending money to Banesco Venezuela.

A single typo in the Banesco account number or name can cause your transfer to fail or get held for review.

Banesco may take longer to process incoming transfers, especially during local holidays or outside business hours.

Declined cards, insufficient funds, or fraud alerts can block your transaction.

A poor internet connection or an outdated app can interrupt the process before it even begins.

Best practices for a smooth transaction

Taking a few extra seconds before hitting "send" can save you hours of troubleshooting later. Here are some best practices to keep in mind.

Name, account number, and phone number should be accurate and complete.

This helps reduce the risk of local banking delays.

This may prevent extra fees and improve approval success.

An up-to-date app and stable internet connection help avoid technical issues.

You can usually monitor your money transfer in real time.

Reach out to support if anything seems off.

Why use BOSS Revolution for transfers to Banesco?

The BOSS Money app from BOSS Revolution offers a powerful combination of affordability, speed, ease of use, and trust. It’s the preferred choice for millions of customers who send money internationally. Consider this:

Competitive fees and fast transfers

Transfers are fast, often arriving at your recipient’s Banesco account within minutes. Enjoy cost-effective fees, and your first two transfers are free (or use promo code APPBONUS to make it three). No hidden charges or surprises.

Ease of use compared to competitors

The BOSS Money app is intuitive and quick to use, even if you’re not tech-savvy. You can set up your account in seconds, enter recipient details once, and track every transfer in real time. There’s no need to visit a store location or retype details every time in the app.

Security and customer support benefits

Your funds are safe! BOSS Money uses secure encryption and fraud prevention technology to protect every transaction. And if you ever have a problem or question, you can get real support from real people.

Sources: all third party information obtained from applicable website as of March 27, 2025

-

https://www.bnamericas.com/en/company-profile/banesco-banco-universal-ca-banesco

-

https://www.moneygram.com/mgo/us/en/m/send-money-to-venezuela/

-

https://www.paypal.com/us/digital-wallet/send-receive-money/send-money-internationally/send-money-to-venezuela

-

https://www.riamoneytransfer.com/en-us/send-money/

This article is provided for general information purposes only and is not intended to address every aspect of the matters discussed herein. The information in this article is not intended as specific personal advice. The information in this article does not constitute legal, tax, regulatory or other professional advice from IDT Payment Services, Inc. and its affiliates (collectively, “IDT”), and should not be taken or used as such by any individual. IDT makes no representation, warranty or guaranty, whether express or implied, that the content in this article is current, accurate, or complete. You should obtain professional or other substantive advice before taking, or refraining from, any action on the basis of the information in this article.