How to send money from the US to Banco de Venezuela online

In the 1990s, Venezuela struck liquid gold (oil) and became one of the richest countries in South America. But, as global oil prices dropped and political problems grew, Venezuela’s economy started to fall apart at the turn of the century. Today, it continues to face a long economic crisis with high prices, low wages, and political struggles. This economic collapse has forced millions of Venezuelans to flee the country.1, 2

According to the UNHCR, there are now over 7.7 million Venezuelans who have migrated to other countries.3 Most of these migrants send remittances to help support their families and communities struggling back home. However, even sending money to Venezuela can be difficult, especially in the United States, where many banks do not offer wire transfers to Venezuela.

Best online money transfer services to Banco de Venezuela

Banco de Venezuela is one of the oldest and most trusted banks in Venezuela. A state-owned bank, it offers stability and accessibility to bank users. Yet, sending an immediate transfer to Banco de Venezuela from the United States is not that easy because not all U.S. banks support money transfers to Venezuela.

Wells Fargo4, for instance, allows remittances to only three countries in South America: Colombia, Ecuador, and Peru. US Bank5, 6 also has no services for international ACH or wire transfers to Venezuela. Some banks, like Chase7, use Zelle for wire transfers. Although Citibank and Bank of America offer Banco de Venezuela transfers, the fees are very high.

For now, money transfer services are the best way to send money from the US to Venezuela. Here are some of the providers you can go to for an online transfer to Venezuela.

BOSS Revolution

With BOSS Revolution, you can send any amount from $10 to $2,999 to an account at any partner bank in Venezuela. Your recipient will receive the equivalent amount in bolivar (VES) based on the exchange rate set by the platform on the date of the transaction. The funds are typically transferred to the local bank account within minutes.

MoneyGram8, 9

Banco de Venezuela is among the participating banks on MoneyGram. You can send money directly to any BDV account using MoneyGram online or at any MoneyGram branch. You’ll need the recipient’s full name, ID number, mobile number, bank name, and 20-digit bank account number to process the transfer. Your recipient gets the money in VES on the same day or the next business day.

Sendity10, 11

If you’re in Europe, you may opt to use Sendity for your money transfer needs. Just create an account to send bolivars or dollars to the Bank of Venezuela. You’ll need the recipient’s ID number and 20-digit bank account number to initiate the transfer process. Sendity converts currencies at the real exchange rate but dynamic transfer costs might affect the actual amount your recipient gets.

How to send money from the US to Banco de Venezuela step-by-step

Among the money transfer services we mentioned above, BOSS Revolution offers the most flexibility when it comes to receiving transfers. Aside from bank deposits, recipients can also get remittances through cash pickup, mobile top-up, and direct-to-debit.

To send money from the US to Banco de Venezuela using BOSS Revolution, follow the steps below:

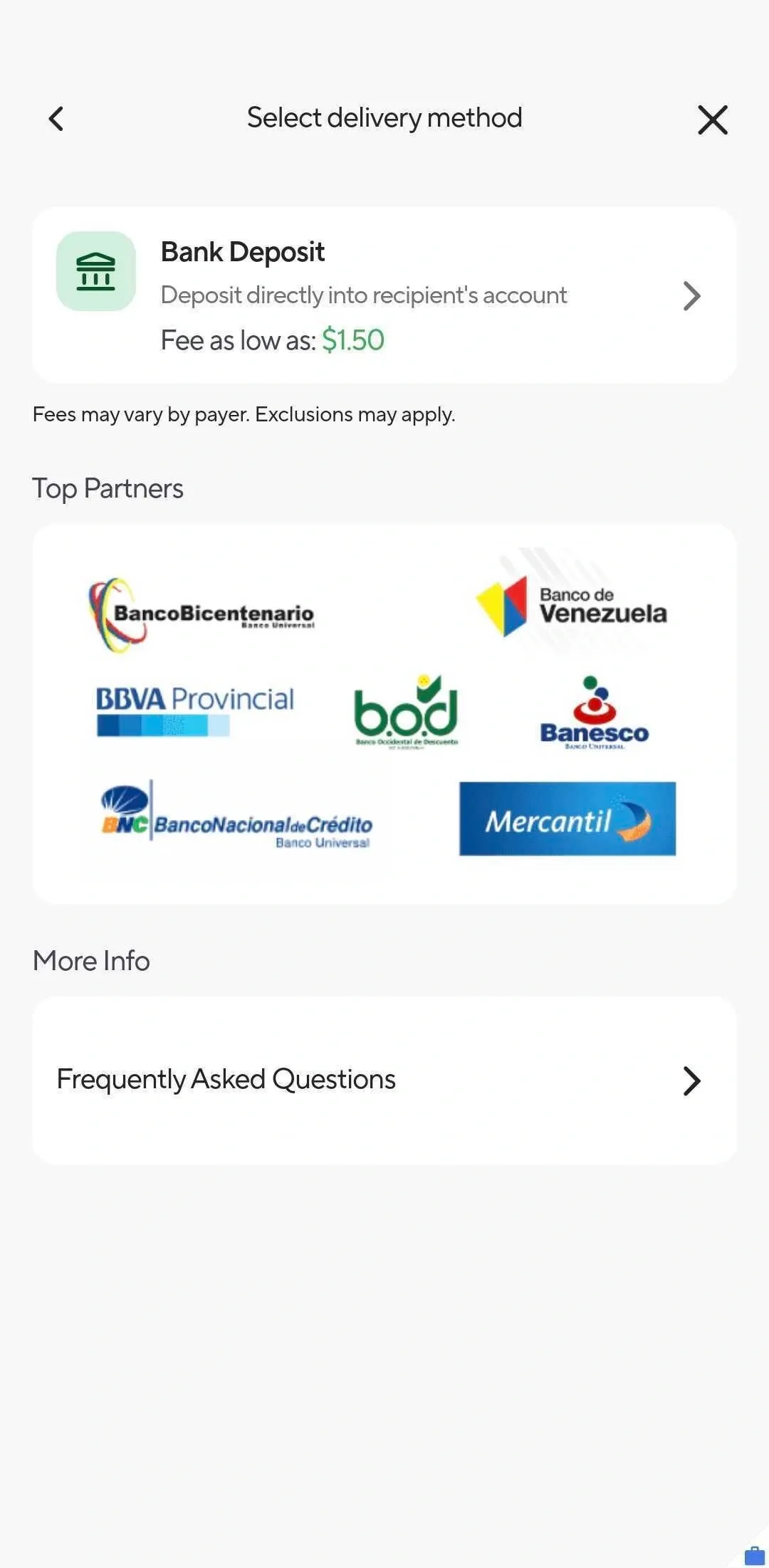

- Open the BOSS Money App.

- Tap “Send Money” and select Venezuela.

- Enter the amount you want to send.

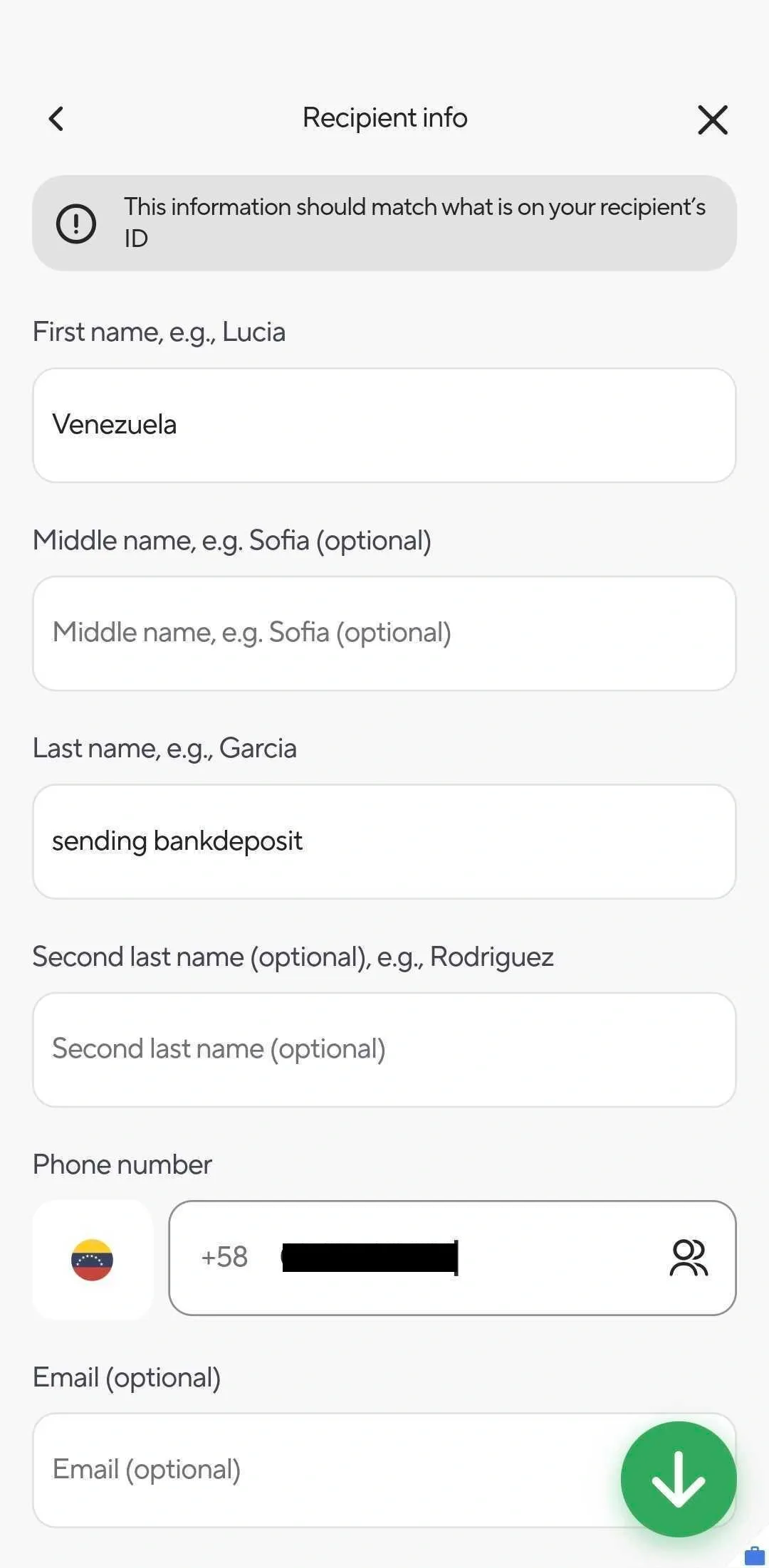

- Select bank deposit and add recipient details (full name, address, phone number, email, bank account details).

- Select a payment method (credit or debit card).

- Review the transaction details and confirm the transaction.

Once you’ve completed the transfer process, the money will be instantly sent to your recipient within minutes. You can track the transfer using the BOSS Money App.

Costs, fees, and exchange rates

Transfer fees vary depending on the bank or service provider. The type of transfer, currencies, and countries involved can also affect costs.

For Venezuela transfers, the exchange rate also impacts the amount your recipient will get. Currency conversions in the country are now set by DICOM and fluctuate frequently due to the country's economic instability. So, it’s important to check the exchange rates before you process a money transfer.

Other fees you need to watch out for are exchange rate markups, credit card surcharges, receiving fees, and additional service fees.

How long do transfers to Banco de Venezuela take?

Traditional international bank transfers to Banco de Venezuela typically take 1 to 5 business days. The actual transfer time depends on a bank’s specific workflow. Some banks have cut-off times for international transfers, compliance protocols, and routing mechanisms using intermediaries. These can delay money transfers.

For immediate transfers, choose banks or money transfer service providers that offer online services. Their online process expedites transfers and completes them within 48 hours.

Common issues and how to solve them

Whichever bank or transfer service you use, you may encounter occasional problems. Here’s how to handle the most common issues:

Delays in processing

Bank holidays, intermediaries, transaction volumes, and other external factors can cause delays. To avoid this, use instant transfer services like BOSS Revolution. Also, schedule your remittances in advance of holidays and weekends.

Account verification issues

Incorrect recipient details, unverifiable identities, and fraud checks can result in canceled or blocked transfers. Make sure the information you provide matches your ID and the recipient’s ID. Have supporting documents ready in case you’ll be asked for further verification.

Transfer limits and restrictions

Some countries, including Venezuela, may limit the amount for foreign transactions. If sending large amounts, you may need to split the transfer over multiple transactions.

Why use BOSS Revolution to send money to Banco de Venezuela?

For many years now, BOSS Revolution has kept its commitment to addressing the needs of immigrants. Our international money transfer services ensure that they have access to an affordable and secure way to send remittances to their home countries.

Affordable transfers

Our fees are relatively lower compared to others. For new users, the first two transactions are free of charge. Subsequent transfers start at $0 when you pay with a debit card.

Accessible services

With the BOSS Money App, you can send money to Venezuela anytime, anywhere in the United States. While you can send money directly to any Banco de Venezuela account, you also have the option to send it to other partner banks and financial institutions. If your recipient does not have a bank account, you can send funds through mobile top-up or cash pickup in agent locations.

Fast and secure transactions

Our infrastructure and operations are protected by industry-leading data security. We guarantee that all transactions done through our app and website are safe and secure. However, we do encourage users to apply necessary security protocols on their end.

Transparent charges

All fees, including exchange rates, are shown on the app. You’ll know the exact amount your recipient will get before you send the money.

Reliable customer support

BOSS Revolution, as an IDT service, is backed by 20 years of excellent service. We currently serve more than 1.5 million customers who regularly send remittances to their home countries.

Final thoughts

Sanctions may limit bank-to-bank transfers between the United States and Venezuela. Fortunately, there are alternative ways to send money internationally, including direct deposits to Banco de Venezuela. Citibank and Bank of America are among the few US banks that support transfers to Venezuela, but their fees are quite steep.

For those who need to send money regularly, money transfer service providers such as BOSS Revolution are a better choice. BOSS Revolution, in particular, offers low fees and good exchange rates for instant transfers.

When choosing the best method to send money to Banco de Venezuela, consider all costs involved and the speed of transfers. This guide will hopefully help you compare the best options available so you can choose the best one for your needs.

Sources: all third party information obtained from applicable website as of March 27, 2025

-

https://www.cfr.org/backgrounder/venezuela-crisis

-

https://crisisresponse.iom.int/response/venezuela-bolivarian-republic-crisis-response-plan-2025

-

https://reporting.unhcr.org/operational/situations/venezuela-situation

-

https://www.wellsfargo.com/international-remittances/south-america/

-

https://www.usbank.com/corporate-and-commercial-banking/solutions/international-banking/global-payments/ach.html

-

https://www.usbank.com/dam/en/documents/pdfs/corporate-and-commercial-banking/international-ach-countries-currencies.pdf

-

https://www.chase.com/personal/personal-account/faqs/send-and-receive-money

-

https://moneygram.com.ve/recibir-dinero-a-una-cuenta-bancaria

-

https://www.moneygram.com/mgo/us/en/help/faq/sending-money/

-

https://www.sendity.com/en/send-money-venezuela/

-

https://www.sendity.com/en/contact/?cat=Venezuela

-

https://www.citi.com/online-services/wire-transfers

-

https://www.bankofamerica.com/online-banking/service-agreement.go#cat6_topic2

-

https://www.bankofamerica.com/deposits/wire-transfers-faqs/

This article is provided for general information purposes only and is not intended to address every aspect of the matters discussed herein. The information in this article is not intended as specific personal advice. The information in this article does not constitute legal, tax, regulatory or other professional advice from IDT Payment Services, Inc. and its affiliates (collectively, “IDT”), and should not be taken or used as such by any individual. IDT makes no representation, warranty or guaranty, whether express or implied, that the content in this article is current, accurate, or complete. You should obtain professional or other substantive advice before taking, or refraining from, any action on the basis of the information in this article.